Hybrid vehicle purchase Incentives : Federal Tax Credits & State Incentives

| Federal Tax Credit: | |

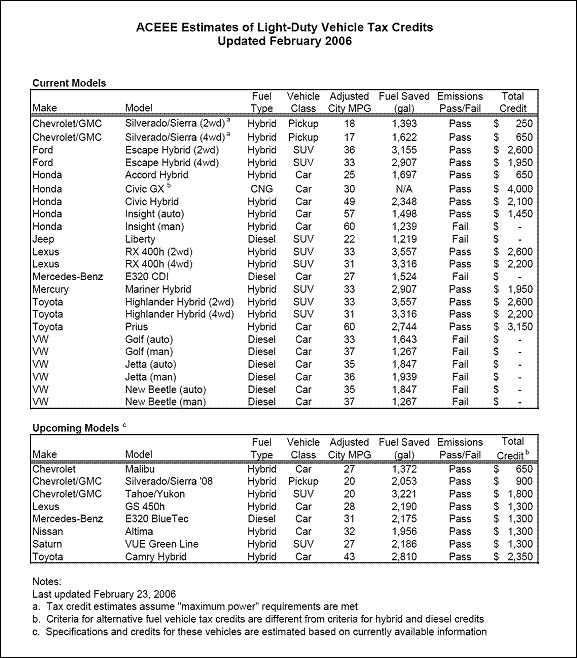

There is a new and improved tax incentive for hybrid cars started from January 01, 2006, which are much better then previous tax incentives. The new law allows a $400 to $3400 tax credit depending on model. This is better because it a tax credit directly reduces taxes owed, as opposed to simply reducing taxable income (before January 1, 2006 the incentives was deduction). The IRS has not announced how the new tax credit will going to work. So there are confusions. But the American Council for an Energy Efficient Economy (ACEEE) has provided the following estimates which will give you a general idea

This table gives you a general idea how much tax credit you will get for particular vehicle. But you should wait for IRS announcement to determine exact hybrid tax credit amounts. There are some basics you should be ware of about tax incentives: · Vehicle must be Purchase and get delivered on or after Jan. 1, 2006. · Must be a new vehicle · Purchase the vehicle with the intention of using it, not re-selling it. The tax credit is set to expire in 2009 and will Phase-Out set by step. It s depend on number of vehicles an automaker has sold. Once an automaker has sold 60,000 hybrid vehicles the tax credit for that automakers’ hybrids is slowly reduced over the next five consecutive quarters. Here is the Phase-Out steps detail:

Tax incentives before January 01, 2006: Energy Policy Act of 2005 which allow superior tax incentives, certain hybrid cars were eligible for the Clean-Burning Fuel Tax Deduction for tax years 2004 and 2005. Hybrid cars eligible are: · 2005 -2006 Ford Escape Hybrid · 2000-2006 Honda Insight · 2003-2006 Honda Civic Hybrid · 2005-2006 Honda Accord Hybrid · 2001-2005-2006 Toyota Prius · 2006 Toyota Highlander Hybrid · 2006 Lexus RX 400h · 2006 Mercury Mariner Hybrid The clean-buring fuel deduction is a federal tax deduction up to $2,000 for taxpayers for hybrid vehicles first put into service in 2004 and 2005. The deduction decreases to $500 for hybrid cars placed into service in 2006 and there is no deduction for subsequent years. Some relevant details:

|

- Login to post comments

2 comments for 'Hybrid vehicle purchase Incentives : Federal Tax Credits & State Incentives'

1. using hybrid cars has a lot

using hybrid cars has a lot of advantages.. one of those are more reliable and comfortable as any other car and they have tax benefits..

2. http://www.buyingadvice.com/hybrids.html

I would say because of the high cost of gas and the government trying to find other alternatives of energy, they want to incentive people to use also some other alternatives to reduce the dependency and consumption of gas. Moving to other technologies less gas dependent is the move today, you can save money and get some incentives from the governments.Check the Average sale price in your town for Hybrid Cars: http://www.buyingadvice.com/hybrids.html